Blogs

You will want to see an improvement in your harmony within this several working days. Cellular consider places is actually a time-preserving and personal bookkeeping dream become a reality. As opposed to attending an atm or financial so you can put a great physical look at, you could bring an image of it using your financial app in your mobile and you may publish the image for the lender’s confirmation.

Online casinos real money that accept credit cards | I’m a bank Teller: 9 Grounds Do not Discover More 2 Examining Membership

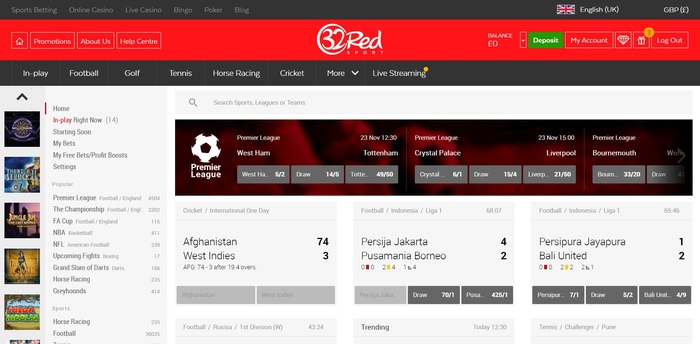

It is known global to be among the best government in accordance British players safe and keeping strict assistance with online casinos. This may only be sent to their mobile, and also you’ll must click a link to help you establish the fresh exchange. After verified, the money would be put in your bank account instantly. Your won’t have even to invest anything quickly either, while the put count might possibly be placed into their mobile phone bill after the fresh week. So it does mean that you ought to be careful even though and plan the greater than usual cellular statement your’ll discover. And black-jack, one of several gambling establishment world’s extremely sought after game is actually roulette.

Betway Gambling establishment

Pursue QuickDeposit℠ try at the mercy of put limitations and fund are typically readily available from the next business day. Discover chase.com/QuickDeposit and/or Pursue Cellular application for eligible cell phones, constraints, terminology, standards and you will details. First, ensure that your financial otherwise borrowing relationship offers mobile view put.

You might quickly choose one of the provided possibilities, as opposed to visiting the ATM’s main eating plan to complete your own detachment. If you wish to withdraw funds from an account aside from the primary family savings online casinos real money that accept credit cards assigned to the debit credit, stick to the Rating cash prompts to the ATM’s fundamental diet plan. Teaching themselves to put a check, for example starting a bank account, is a vital early help the monetary travel. If you make a deposit inside a workplace, you have got instant supply of money. Having mobile put, i procedure their put along with other cellular deposits at the bottom during the day.

Banks run on working days, which can be a tiny distinctive from calendar weeks. Vacations and sundays wear’t amount while the working days, thus any demand generated up to these times can take expanded to help you processes. Next, you’ll be required to see simply how much of one’s salary is to end up being led to each and every of your own profile. This point is going to be specifically of use for those who’lso are saving for specific requirements otherwise looking a means in order to automate their savings.

The mobile device needs a suitable analysis bundle or a good Wi-Fi connection enabling the newest indication of data on the internet. Zimpler’s biggest advantage is based on its self-reliance, providing each other deposits and you will distributions. At the same time, it includes another budgeting tool to deal with gaming costs. But not, their access and you may deal percentage number is totally service provider-centered.

By far the most widely used mobile systems in britain try EE, Three, Vodafone, and you may O2, having EE as the most widely used. Such sites give full 4G and you may 5G visibility and you can a choice of preparations and you can services to complement some other means and you will budgets. You want the newest person’s commissary amount as well as the term of your own correctional business to an inmate during the an excellent correctional business. That it change in processes means that the culprit’s currency have a tendency to instantaneously be there in the event the culprit transfers from one to institution to some other. The fresh culprit won’t must wait for a check getting provided for the brand new studio that he/she left.

Check your borrowing equilibrium and also the services legislation prior to trying including repayments. Really financial institutions limit the new iphone 4 remote consider put total dos,five hundred or lower. Because of this certain profiles will be unable in order to secluded put a paycheck, however for of numerous smaller monitors the option to help you deposit which have an enthusiastic new iphone is incredible.

But not, it’s best never to fool around with societal Wi-Fi the delicate guidance otherwise one thing demanding their bank password. It’s better to use a secure wired otherwise wifi—or their smartphone’s research union—if you wish to avoid discussing delicate guidance. There’s usually a maximum deposit limit one to applies each day otherwise per month, there may also be a limit on the level of monitors you can put. The newest dollar limitation differs from financial so you can bank, you could usually deposit several thousand dollars monthly.

The brand new put count constantly selections anywhere between fifty and 200, based on the room type of as well as the facilities that you’re going to you want via your hotel remain. It same smoother solution are used for legal-purchased, probation and you may parole payments. Call us today to begin taking advantage of everything you Safer Dumps can do for your department.

Yet not, there is particular Texts capable number that may not work with the Text messages notification system. The newest citizen have a tendency to reply to your Texting in the same manner as the responding to a contact delivered from the JailATM webpages. This isn’t simple for the fresh resident to go into a phone count as the a person to possess messages.

To close out – if you have less than perfect credit otherwise minimal borrowing from the bank it’s constantly lesser just to find the cellular telephone downright and go with a prepaid plan. I think when someone hear “prepaid” they nonetheless think about the TracFones out of 10 years before…but the majority prepaid arrangements now secure the current mobile phones, along with new iphone and you can Samsung Galaxy. To check on broker availability by product otherwise service, log in to On line Banking, hover along the Help & Service tab, discover Contact us and pick a subject and then discover Wade. Stop by at generate in initial deposit to a phone membership and you will/otherwise commissary membership.

This video game can be somewhat harder to follow very constantly people tend to grasp the principles from most other online game, such roulette and black-jack before taking they for the. From the of many shell out from the cell phone gambling enterprises, there’s web based poker competitions offered to partake in that will probably render very big cash awards to the champions. If you discover to’t utilize this transferring solution, you do not have to worry, as the all of the sites i’ve demanded along with undertake a great many other kind of payment also. A pay because of the cellular telephone gambling establishment are an on-line gambling establishment that allows professionals to put through their mobile phone expenses. Lastly, you want to make sure that gambling enterprises have to give you a knowledgeable gaming application. Cellular put try a simple, smoother and you may progressive way to deposit monitors when, everywhere.

Terminology, requirements and you can charge to own account, points, software and you may functions are susceptible to alter. Never assume all account, things, and you will functions along with rates revealed listed below are found in all of the jurisdictions or to all customers. Your own eligibility to possess a particular tool and you will provider try subject to a last devotion by Citibank. Very online banking institutions that enable bucks dumps do it in the drugstores, Walmart otherwise find ATMs. Chime, concurrently, features a thorough system out of 17 extra put-recognizing lovers and make getting bucks to your online checking account easier.

However,, the newest deposit restrictions about element could possibly get sway the option of the lending company. All the information and you may actions mutual a lot more than are fantastic a means to make sure you’lso are advised and you will provided to guard on your own facing mobile deposit con. Yet not, fraudsters try skilled and you may persuading, and you may become opened even with your best work.

Your financial organization uses unique information, such as a code, to help you de-password every piece of information and you will put your cheque securely. Ask your lender when money from a cellular cheque put might possibly be offered. Inmate account also are familiar with afford the co-payment to possess therapy and visits to the jail’s medical infirmary is always to they get sick. Commissary finance ensure it is prisoners to shop for items such private hygiene points, foods and stationery provides on the prison shop. The system is found in the newest reception or visitation part of the fresh Henry Condition Jail. Ahead of booking, request the hotel’s deposit rules, the quantity required, and also the common kind of fee.

This will range from 10,one hundred thousand to a hundred,100000 for each and every look at or per day. Very first, there’s the newest PrimeWay Mobile Banking App, you could deposit inspections, import currency, and so much more. PrimeWay will be here to go all of your desires and we want to be debt partner. You can expect versatile conditions and competitive cost for the our band of finance which can work with your allowance and fit your existence. We recommend that you lock their mobile phone using a PIN otherwise biometric protection such fingerprint or facial detection. Using this defense function for the device will help prevent not authorized use of your phone’s articles, in addition to access to an automatic teller machine.

Don’t wait for the monthly comments to test their profile. With cellular banking, it’s very easy to look at account anytime you like in order to validate one your asked payments had been canned and you may deceptive purchases haven’t. The sooner the thing is doubtful hobby, the sooner something can help you to prevent they. It is usually far better get in touch with the resort in person to have clarification.

Generally, 30 days is enough time to make sure a check tend to never be rejected. You can examine the newest reputation of one’s take a look at from the Cellular Banking Application from the simply clicking Put Consider Records. When it’s time for you to dispose of their view, make sure you shred it.

A typical need is if the new sender’s lender takes lengthened so you can process the newest import. In these instances, Dollars Application receives the finance but awaits verification in the bank before upgrading the brand new deposit reputation on your account. This process usually takes a few hours otherwise a couple out of business days. Always inside a couple working days private inspections but as much as seven for many accounts. Usually one to business day for government and you may cashier’s monitors and you will checks on the exact same financial one keeps your account.